How Virtual Assistants Can Help You Scale Smarter and Live Freer

When most entrepreneurs think about growing their business, they imagine working harder, longer hours, and juggling more responsibilities. But what if scaling didn’t have to mean doing more yourself? What if the key to growth was letting go?

That’s exactly what Harley Green, entrepreneur and digital nomad, discovered—and now helps others do through Workergenix.

Why Virtual Assistants Are the Game-Changer You’ve Been Looking For

At its core, a Virtual Assistant (VA) is someone who works remotely to handle tasks you shouldn’t be doing. Think admin, marketing, bookkeeping, scheduling, and customer service—all the things that keep you busy but don’t directly grow your bottom line.

Many business owners think they can’t afford help, especially in the early stages. But the truth is, you can’t afford not to delegate. Harley and his wife Adrienne realized this early on in their real estate investing journey. They were working full-time jobs while managing a growing investment portfolio—and it was taking away from their life.

They hired their first VA and everything changed.

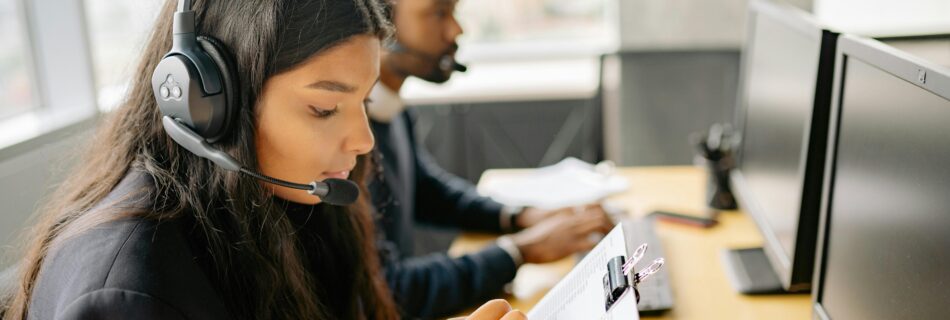

Now, they help other business owners scale smarter by connecting them with top-tier virtual assistants from the Philippines—professionals who are highly educated, fluent in English, and eager to support growth-driven entrepreneurs.

Why the Philippines?

- English Proficiency: English is widely spoken, making communication seamless.

- Strong Work Ethic: Cultural alignment with U.S. businesses and a dedication to doing excellent work.

- Affordability: You can hire a skilled, full-time VA for around $20,000/year—compared to $60,000+ for a U.S.-based assistant.

Overcoming Common Fears

One common concern is security—sharing sensitive data with someone halfway around the world. But Harley, with a background in cybersecurity, emphasizes that VAs in the Philippines don’t have direct access to U.S. banking systems, lowering risk. Plus, with Workergenix, clients are protected through liability and cyber insurance, offering peace of mind.

Who Should Hire a VA?

- Entrepreneurs spending too much time on admin or repetitive tasks.

- Solopreneurs struggling to grow because they’re doing everything themselves.

- Growing teams needing cost-effective executive support.

Whether you’re a solo operator or leading a growing business, if you have tasks that can be done via phone or computer, you can benefit from delegating.

Start With the Right Mindset

Many try to cut costs by hiring part-time or ultra-low-cost VAs—but that often leads to high turnover and wasted time. Harley’s advice? Think value, not just cost. A skilled, full-time VA can take 80% of your day-to-day tasks off your plate, freeing you up to focus on high-impact growth activities.

The Process: How to Start with a VA

- Assess Your Tasks: Write down what you do daily. What can someone else handle?

- Create a Role Description: Define what you need help with.

- Decide on Hours: Aim for full-time for best results.

- Hire Smart: DIY, use a placement agency, or work with a full-service provider like Workergenix to take care of it all.

Culture and Communication Matter

Hiring a VA isn’t just a transaction—it’s a relationship. Regular video check-ins, clear expectations, and genuine connection make the difference between success and frustration. With the right support, your VA becomes a true extension of your team.

It’s a Win-Win

VAs get life-changing opportunities—helping their families, buying homes, and living better lives—while you get your time back to focus on what matters most.

Ready to find out how a Virtual Assistant can change your business (and your life)?

Let’s talk. Schedule a discovery call and take the first step toward scaling smarter.